Your 401(k) Might Soon Shop Private Equity—Why That’s a Big-Deal

Picture this: a White House executive order (expected any week now) tells regulators, “Hey, let 401(k)s invest into private markets.” That means target-date funds could carry a 5-20 % sleeve of buy-outs, late-stage VC and private credit—right inside your day-job retirement plan. It’s up to each employer to add the option, but once even a handful do, trillions of “set-it-and-forget-it” dollars suddenly have a path to PE land.

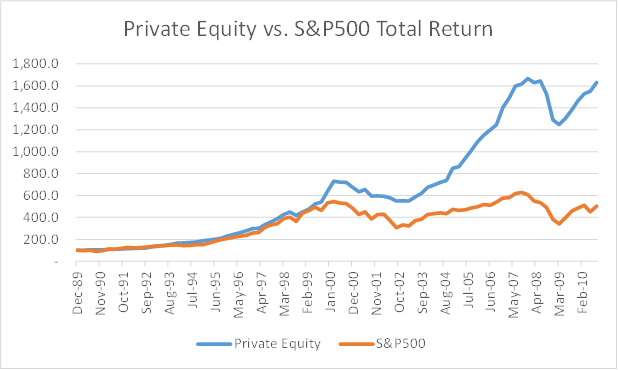

Catch the Wave Early

And this is just one brick in a much bigger wall that’s being moved in favor of private investments:

- Accredited-investor rules are loosening. A House-passed bill lets people qualify through professional credentials or coursework, not just a fat W-2 or seven-figure net worth. NAPA NetCongress.gov

- 100 % bonus depreciation is back. The freshly minted “Big Beautiful Bill” restores full first-year write-offs through 2031—catnip for PE firms that love buying cash-flowing assets and front-loading tax breaks. KBKGYeo and Yeo This alone is going to drive up valuations of real estate and other deals with significant depreciation.

- Big plan providers are already gearing up. Goldman, BlackRock, and friends are launching private-credit and PE collective trusts so they’re shelf-ready the minute the rules drop. Wealth Management

Why Prices Could Pop

Whenever a new class of buyers shows up—ETFs in the ’90s, Robinhood traders in 2020—valuations get a lift. If even 5 % of annual 401(k) flows wander into private equity, that’s roughly $40 billion a year in fresh demand chasing a much smaller supply of quality deals. Add in newly credentialed accredited investors plus sponsors juicing returns with bonus depreciation, and you’ve got a recipe for steadily higher entry multiples.

Translation: early money rides the tailwind; late money funds it.

How to Play It Before Everyone Catches Up

- Check your status. If the accredited-rule change passes the Senate, you may be eligible for deals that used to be off-limits.

- Load up outside the 401(k). Direct LP stakes, private-credit notes, and late-stage SPVs are open right now, often at lower fees than the mass-market retirement version coming later.

- Use the tax kicker. Deploy capital into asset-rich businesses where you can hammer that 100 % bonus depreciation from day one.

Next move: Watch Ticker Tape presentations like How to Invest Like the Ultra Wealthy, Pre-IPO Investing, and More. Also, make sure you are following us on LinkedIn, YouTube, and Facebook.

Hashtags: #PrivateEquity #AlternativeInvestments #401k #HNWInvesting #TaxEfficientInvesting #SmartMoney #PreIPO

ai alternativeinvestments billionaires Blockchain BOI Business crypto Cryptocurrency Diversification duediligence Education EstatePlanning fund Government Healthcare HighNetWorth Hotels Hyatt Centric Impossible Foods incometax Investments IRA Kraken PassiveIncome popular Portfolio Portfolio Company Pre-IPO privateequity Real Estate self-directed IRA SPAC stocks tax-efficient-investments tax-loss-harvesting taxes taxstrategies taxtips Trust ultrawealthy USARareEarth utilityrescue venturecapital VIV WarrenBuffett